Even if you are not required to file a tax return, you may still qualify for tax credits like the Earned Income Tax Credit (EITC) and the Child Tax Credit. Tax credits reduce the amount of taxes you owe and may provide a refund at tax time. Here’s what you need to know about filing taxes if you are a returning citizen or currently incarcerated. In short, making the process of filing your taxes as unpleasant as possible is a very big and very lucrative business.Re-entering society can be a challenging time. Second, in an echo of the problem with payday lenders, poor Americans often lack bank accounts and face other challenges that give tax preparation companies even more opportunities to fleece them. First off, they desperately need what tax breaks they get, and have less time or resources than anyone to claim them. "We anticipate that governmental encroachment at both the federal and state levels may present a continued competitive threat to our business for the foreseeable future," Intuit told its investors recently.Įven worse, poor Americans are particularly vulnerable to exploitation. Now, there's a more likely reason the industry opposes return-free filing: It would massively cut into their customer base and revenue. Return-free filing just cuts out the nonsense beforehand. In return-free filing systems as in our own, you don't have to accept the government's version. But both systems end at the same place: The government tells you what it thinks your liability is, and you either challenge it or you don't. The tax preparation industry and its allies in Congress argue that making the IRS both tax collector and tax preparer would create a conflict of interest: The government wants more tax revenue, so it might inflate your tax liability by not giving you all the credits and deductions you qualify for. Warren called the setup "a front for tax prep companies who use it as a gateway to sell expensive products no one would even need if we'd just made it easier for people to pay their taxes.” Her staff even issued a long and detailed report based on much of ProPublica's work. Meanwhile, the industry uses that partnership as leverage to get the IRS to sign agreements that it won't create a free-return system. While 70 percent of Americans could use this option in theory, under 2 percent actually do. And, not surprisingly, it nudges users towards products that require payment.

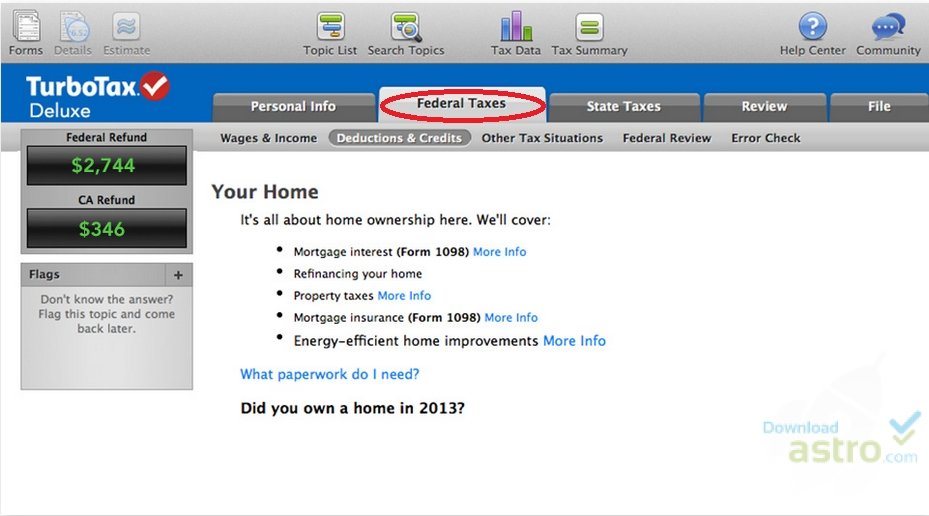

2017 TURBOTAX RETURN FREE FREE

government from embracing return-free filing.Īmerica does have a public-private partnership between the IRS and the tax preparation companies, which ostensibly offers free online tax filing to lower- and middle-class families. The industry even fought similar efforts at the state level, and pushed bills that would explicitly bar the U.S. Multiple congressional attempts to create such a system have crashed and burned, including a 2016 effort by Sen. And one of the main things they lobby against is moving to return-free filing. As ProPublicaand the Sunlight Foundation have documented, the tax preparation industry spends millions upon millions lobbying Congress. That's where Intuit, H&R Block, and their ilk enter the picture.

Past studies estimate that at least 40 percent of Americans would be eligible to get return-free filing, should we move to such a system. The government just cuts to the chase: It prepares everyone's tax returns itself, sends them out, and then taxpayers check the returns for errors. That's why plenty of other countries - Japan, Israel, the Netherlands, Britain, Peru, Sweden, Spain, etc. In other words, filling out your own tax return is often an entirely superfluous step. If the government doesn't agree, taxpayers then choose whether to fight it. So once Americans have filed their returns, the government checks their work against its own calculations, and decides whether it agrees. But when most Americans fill out their wages and dividends and mortgage payments and all the rest on their tax forms, they're not telling the government anything it doesn't already know. Right now, Americans prepare their tax returns themselves.

2017 TURBOTAX RETURN FREE CODE

And we're due for another round of reform.īut regardless of how complicated the tax code itself gets, there's a lot we could do to make the process of filing our taxes quicker and simpler. The mess tends to build over time until, roughly every 30 years, Congress does a housecleaning. So we taxpayers should be grateful, right?Īctually, Intuit and H&R Block and their fellows are a big reason why doing your taxes is so unpleasant.Īdmittedly, one problem here is just that the tax code is really complicated, thanks to all the deductions and credits and carve-outs.

0 kommentar(er)

0 kommentar(er)